|

Betty Tessien

· Sick Dusthunter Discussion

· COVID Disinfection Technologies Webinar Showcases to Unique Technologies

· Novel Approach Uses Food Dyes to Disinfect Air

· Foot Sanitizers for Food and Other Facilities Can Effectively Reduce COVID Transmission

· Valve Market Share Analysis for Hundreds of Companies

· Asia will Account for More Than Fifty Percent of Fabric Filter Purchases This Year

Sick Dusthunter Discussion

A recorded discussion on September 29, 2020 relative to measuring dust emissions from bag filters and electrostatic precipitators is now available on youtube.

Philip Zyskowski – Regional Sales Manager at SICK

John Chitty – Application Engineer at SICK

SICK has a wide range of instruments to measure gases and particulate in power plants and industrial fugitive dust and air pollution applications. Particulate monitors using triboelectric principles have been used for measuring dust emissions to determine broken bags in dust collectors. Accuracy of this approach is limited and depends on assumptions of constant humidity and other parameters. SICK is now offering a Dusthunter particulate monitor which is based on the forward scattered light principle. Its accurance is +/- 2%. This device is competitively priced and extends the uses and value to a number of applications. One would be fine tuning rapping processes in electrostatic precipitators. Its accuracy allows identification of specific bags with holes rather than just large groups. In this recorded discussion Phil Zyskowski drew on his many years of experience to explain the principles, advantages and use of Dusthunter. His presentation was accompanied by discussions which included John Chitty of SICK and Bob Mcilvaine

The DUSTHUNTER SP30 can be used to locate defective filter bags in cyclically cleaned hoses or filter bags.

Prerequisites

• Cyclic cleaning of filter bags

• Debounced synchronizing signal (DI4) with a duration of 100 ... 900 ms

• Pulse interval at least 0.5 s and greater than 2x T90 time for the dust concentration measurement

Input parameters required

• Number of filter hoses in a filter bag

• Impulse interval

• Delay time between purge bursts

The advantage of this forward light scattering approach is the higher accuracy over tribolelectric technology. This allows analysis of process parameters and is in general superior for use relative to process management.

The PowerPoints are shown at: http://home.mcilvainecompany.com/images/SICK_Dust_Measurement_for_ESP_and_Baghouse_PZ_JS.pdf

The YouTube can be viewed at: https://youtu.be/yi7TNxjG6G4

COVID Disinfection Technologies Webinar Showcases to Unique Technologies

Today we recorded a discussion with presentations of two technologies and then insights on applications including schools, film studios, restaurants, transportation and food processing plants.

Photodynamic Airborne Cleaner

Ozone and UVC Shoe Disinfection Technology

Review of Applications Including Schools and Food Processing Plants

This webinar can be viewed at: https://youtu.be/_Lu4Om6I15c

Novel Approach Uses Food Dyes to Disinfect Air

Young Kim of Purdue University described the Photodynamic Airborne Cleaner (PAC) which inactivates the virus by creating singlet oxygen.

“Our biomedical engineering lab has developed a way to potentially neutralize viruses lingering in the air using aerosols of FDA-approved food coloring dyes. Aerosols are tiny bits of solid or liquid matter suspended in air.

“Our idea was inspired by photodynamic therapy, which is a medical treatment, including for certain types of cancer. Photodynamic therapy uses a photosensitizer, a chemical that reacts with oxygen in the presence of light, to produce oxygen free radicals. These radicals are highly reactive, meaning they trigger other chemical reactions, including ones that kill harmful pathogens.

“Instead of using expensive medical photosensitizers, we have identified several FDA-approved food coloring dyes that can be used to generate free radicals in visible light. We use ultrasound to generate small aerosols containing the food coloring so that the dyes can float and linger in the air. The aerosols are barely visible, and their small size and short lifespan in light means they don’t stain surfaces.”

Young showed other distribution methods including a drone which could traverse a convention hall or other large space. In the later discussion he agreed with the observation by Bob McIlvaine that if this was injected in the outlet of a fan filter unit above a checkout counter it would provide deactivation in an area of high traffic.

Here is how the technology works.

The PAC has advantages in terms of safety since it uses food dyes.

Young described considerable effort which has been undertaken to create droplets in the 5 micron range. These are small enough to be widely distributed but large enough to avoid penetration into the lungs.

In the subsequent questioning concern was raised that the 5 micron droplets would start to evaporate and form smaller aerosols. On the other hand if those people in the range of the droplets are wearing masks then there should not be a problem. One can visualize a modus operandi where people wear masks when they are not social distancing but when at their desks can remove the masks. They would then put them back on if there would be a spraying event in the area.

The PAC offers a new option which deserves very thorough review.

To view the power points click on http://home.mcilvainecompany.com/images/Mcilvaine_10-1-2020_Purdue_Univ_YKim.pdf

this was the first presentation in the webinar. To view the recording click here: https://youtu.be/_Lu4Om6I15c

Foot Sanitizers for Food and Other Facilities Can Effectively Reduce COVID Transmission

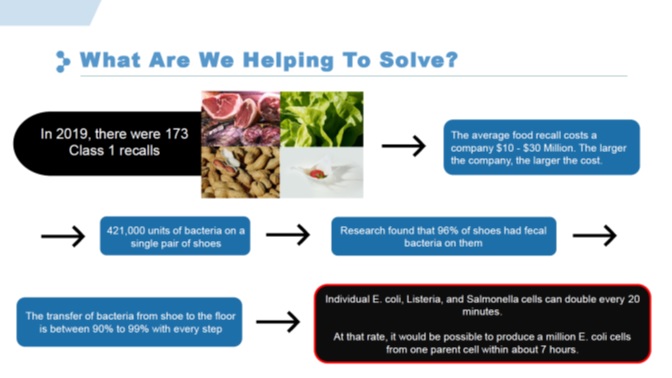

Robyn Collins of PathO3Gen updated us on the value of foot sanitizers. The company has continued to make progress since the last webinar with them. Food companies have been hard hit by COVID. In addition they face other risks from pathogens including food recalls. Here some of the impacts in the U.S.

Food companies have even more to be gained from the use of foot sanitizers than does the average industrial plant owner. Many owners of buildings whether industrial or commercial will benefit from the foot sanitizer because it will prevent the viruses on shoes from entering the building and spreading not just to the floors but to walls and furniture. Studies attest to the ability of these viruses to become airborne and reach elevated areas within a hospital but in other facilities as well.

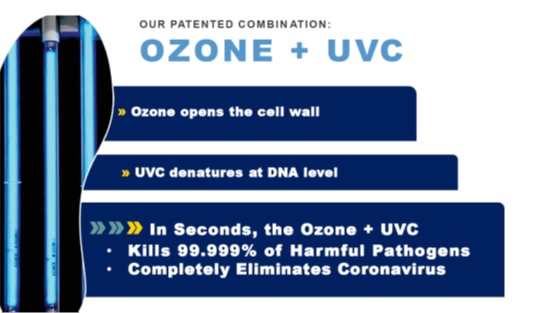

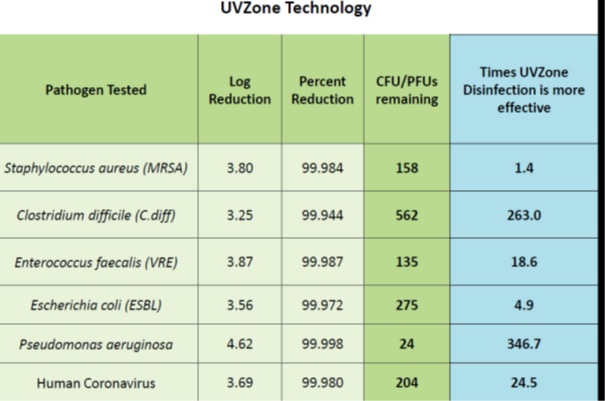

Stepping on the sanitizer for as little as 8 seconds provides the necessary deactivation. The effectiveness is due to combining ozone and UVC.

The effectiveness of the combination is much greater than just UV

There are many applications where the foot sanitizer will be cost effective. Since the cost is only $13/day or less for one unit it is economical for even small applications. Another viewer today asked about residences. She lives in a building with 100 residences. So the cost per day is less than $0.13 per family. The fact that shoes showed high levels of fecal matter makes it particularly advantageous for apartment and condominium dwellers.

There was also discussion as to whether the high value of the sanitizer is not proven by the low level of COVID spread in Japan. The custom in that country is to remove shoes prior to entry to a residence.

Maybe this is a good way to sell the technology. You can ask subway riders in NY whether they would rather take off their shoes while riding or step on the foot sanitizer.

To view the PathO3Gen power points click here: http://home.mcilvainecompany.com/images/PathoGen3_Presentation_093020.pdf

This is the second presentation in the recording. To view it click here: https://youtu.be/_Lu4Om6I15c

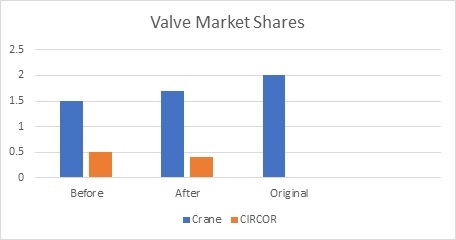

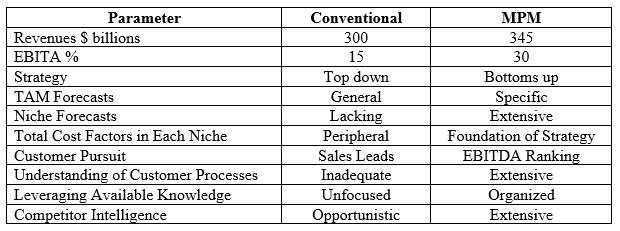

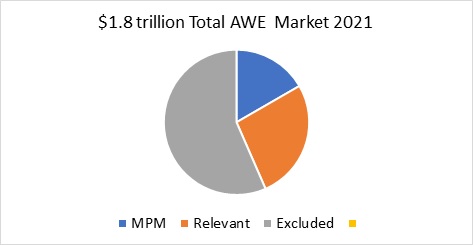

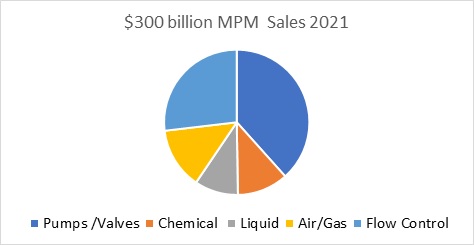

Valve Market Share Analysis for Hundreds of Companies

Market shares of valve companies are changing at higher than historical rates. Some of the reasons are

- Pandemic

- Nationalism

- Disparate growth by application

- Disparate growth by region

- Disparate growth by valve type

- IIoT & Remote O&M

The fact that the pandemic has impacted Asia less than the Americas favors those companies with higher ties to Asia. The politics of nationalism is also having an impact. The trend toward IIoT is a big opportunity to increase revenues and differentiate the product from the competitors.

Another factor is the industry focus. Those companies focused on coal fired power have suffered while those pursuing biopharmaceuticals have seen double digit market growth.

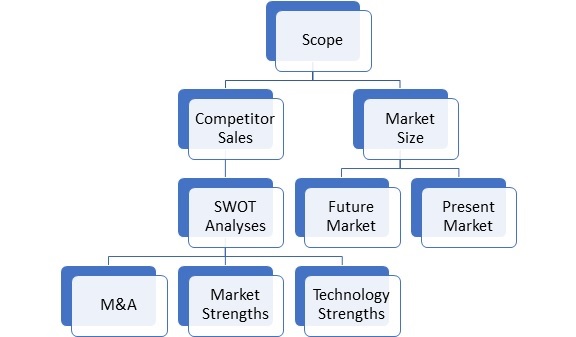

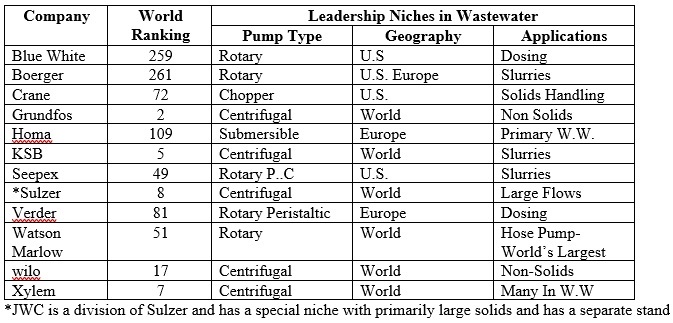

The McIlvaine market share analysis for each valve supplier is valuable for those companies considering acquisitions, divestiture or seeking to increase share organically. This continually updated database and analysis is part of Industrial Valves: World Markets

https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

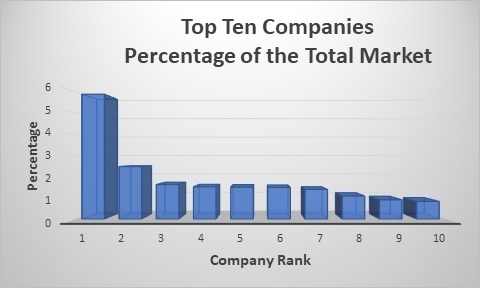

There have been a number of mergers, acquisitions, divestitures, and joint venture agreements undertaken by valve companies in the last five years. Emerson has been the most active. The purchase of the valve operations of Pentair (Tyco) the largest valve producer made Emerson the # 1 producer. In the latest 12 months sales are estimated at close to $3.8 billion compared to $1.6 billion for # 2 Cameron Schlumberger. In 2020 Cameron has lost share as its sales were down 19 percent in the second quarter, The largest divestiture was the GE sale of stock in BHGE to the now independent Baker Hughes with valve sales of $960 million.

Baker Hughes has offset some of the market shrinkage in power and refineries by taking advantage of IT. Its SVI3 Digital Valve Positioner, is reducing valve maintenance expenses by as much as 50 percent while improving process control performance.

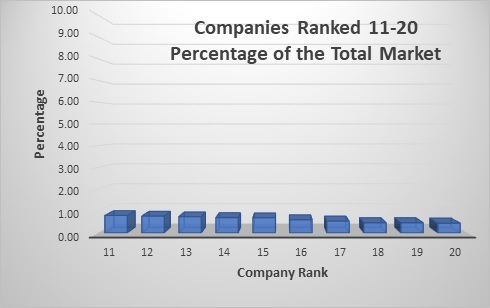

Market shares are being continuously revised to provide worldwide rankings of valve sales by company and further segmented by corporate location.

Of the top six ranked suppliers of high performance valves, five are home based in the U.S. Their sales are equal to 15 percent of the world market. Their sales equal well over 50 percent of the U.S. market. Their success has come from penetration of the markets in the other two regions.

This low percentage for Asian based companies is due to aggressive pursuit of the Chinese market by international valve suppliers. However, Asian valve companies have higher growth rates and we can expect their percentages to increase.

Emerson is home based in the U.S. with 2019 valve sales of $3.79 billion its market share on a worldwide basis is over 5 percent. However, this is equal to18 percent of the market in the Americas. The fact that Emerson has penetrated the Asian and EMEA markets has allowed the company to grow even if it would be very difficult to achieve an 18 percent share on the continent in which it resides. On the other hand, Neway based in China has a 0.7 percent of the total world market. All of its sales represent only 1.6 percent of the Asian market. It is growing internationally. But even if it were not it still has lots of opportunity in Asia. It is successfully competing in the high performance valve market with products meeting the highest standards such as in nuclear power plants.

Emerson’s focus on China has paid off in the pandemic. In the third quarter 2020 Emerson Automation Solutions underlying sales were down 13 percent, however China was up 9 percent.

Neles Corporation was created in the partial demerger of Metso, in which Metso’s Flow Control business became the independent Neles Corporation and continues Metso’s listing on Nasdaq Helsinki. The completion of the partial demerger took place on June 30, 2020. In the last month Alfa Laval made an offer for Neles shares.

Neles is a leading diversified valve, valve automation and service company with net sales in 2019 amounting to EUR 660 million and adjusted EBITA margin to 14.6%. Neles’ headquarters are located in Vantaa, Finland. The company has operations in more than 40 countries worldwide with approximately 2,900 employees.

In July 2020 Neles opened its new, state-of-the-art technology center in Jiaxing, China. This significant investment in China is justified by the size not only of the Chinese domestic market but the sales to Chinese OEMS selling process plants around the world.

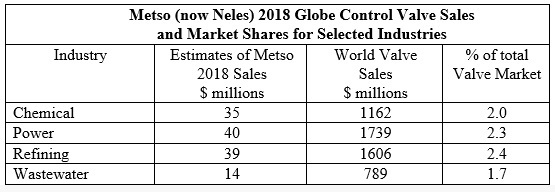

Estimated Metso market shares range between 1.7% to 2.3% for control globe valves in selected industries. Market shares in some other industry/valve type categories are just a fraction of 1%. Metso is the seventh largest valve supplier. Its total market share is 1.4%. Its share in control valves is higher than in on/off valves.

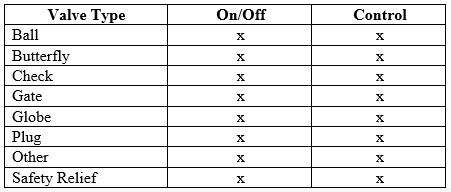

Similar forecasts are available for the valve types shown in the following chart.

For more information click on Industrial Valves: World Markets

https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

Bob McIlvaine can answer your questions at rmcilvaine@mcilvainecompany.com, cell: 847 226 2391

Asia will Account for More Than Fifty Percent of Fabric Filter Purchases This Year

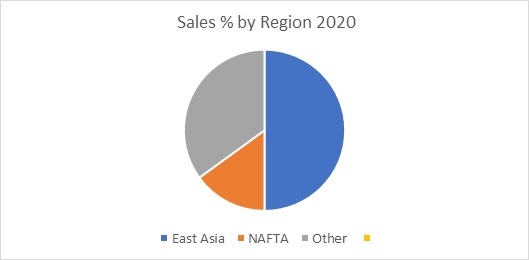

The market for fabric filters for air pollution and in-plant control is down this year. The shrinkage is coming primarily in Europe and the U.S. with Asia showing modest gains. The coronavirus pandemic is largely to blame.

The closure of coal fired power plants will continue in Europe and the U.S. but the market will continue to grow in Asia due to tighter particulate emission regulations. Fabric filters will be selected over electrostatic precipitators for many Asian coal fired plants. The use of dry scrubbing and fabric filters instead of wet scrubbers is a factor in some countries.

Tighter regulations are also helping suppliers of dust collectors for mechanically generated dust (as opposed to products of combustion). Donaldson received a Blue Sky award in China which has some of the world’s toughest emission standards.

East Asia accounts for 50 percent of the market. NAFTA has shrunk to just 15 percent of the total.

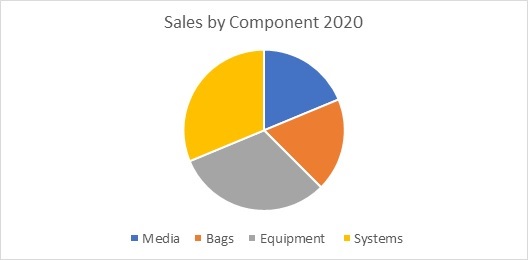

The value added starts with resins, cellulose fibers or glass fibers which are processed into filter media. This media is then converted into bags or cartridges. These cartridges are placed in dust collectors. These collectors are part of systems with fans, motors, controls and connecting ductwork. Since bags are replaced every two years or so, the aftermarket is very substantial.

The system companies are becoming more involved in aftermarket sales. In fact, in China air pollution system suppliers are encouraged by the government to build and operate facilities for the plant owners. The motivation is to assure compliance with emission standards.

There are three types of companies participating in this market

- Media and bag companies

- Equipment and system companies

- Integrated companies

A further segmentation is between those making standard collectors and those making engineered and generally larger collectors. A large power plant dust collector could exhaust 4 million cfm. In contrast a small welding fume collector could exhaust a few hundred cfm.

GE at one time was an integrated company. It owned a large bag manufacturer (BHA) and with Alstom was a leading supplier of large dust collectors. Today GE has lost most of its market value and is exiting the coal business. It sold BHA to Clarcor which in turn was acquired by Parker Hannifin.

In contrast Fujian Longking is the largest supplier of dry scrubbing systems in the world. Its revenues have grown by 30 percent in the last four years and were 10.8 billion CNY in in 2019. Net income before taxes showed a similar growth to 1 billion CNY. Net income rose to 850 million CNY

Parker Hannifin is now an integrated company making media as well as equipment and systems. Clarcor industrial filtration revenues at the time of acquisition by Parker were over $800 million.

Donaldson has annual dust collector sales of $400 million. It has an installed base of 160,000 units and 32,000 aftermarket customers. It is the world leader in the production of standard dust collectors.

In 2000 it introduced a nanofiber media for engine filters as well as dust collectors and has sold 1 billion ft2 of this media.

It makes its own membrane media, Tetratex®. This PTFE membrane is laminated to needled polyester to create a high efficiency media used in pulse jet filters. It also buys filter media from just two media companies.

Lydall has been focusing on the dust collector media market. First it acquired Southern Felt from Andrews. Lydall then acquired Gutsche in 2016. Gutsche supplies non-woven media with much of its sales in EMEA but also has a factory in China. 2016 sales were $50 million of which dust collection was $40 million. In the latest quarter Lydall dust collector media sales including Texcel, Southern Felt and Gutsche were $30 million. So annual dust collector media sales are about $120 million.

BWF remains a larger supplier than Lydall with both media and bag making operations. The privately held company has 1800 employees and 15 production sites around the world. Revenues are $300 million.

There are a number of variables which will impact the markets by region, industry, and media type. the McIlvaine company is continually analyzing the market in Fabric Filter and Element World Market http://home.mcilvainecompany.com/index.php/markets/air/n021-world-fabric-filter-and-element-market

Bob McIlvaine can answer any questions about the report. His email is rmcilvaine@mcilvainecompany.com and his cell is 847 226 2391

|